Introduction: why this comparison matters

Coppel and Elektra dominate Mexico’s credit-driven retail landscape. Both offer in-store financing, store cards, and “meses sin intereses” (MSI) promotions that make big-ticket items affordable by spreading payments over months. But they differ in product mix, financing terms, and how interest or fees are structured. This guide helps you choose the best store for buying on installments—practically and safely.

TL;DR — Quick verdict

Both Coppel and Elektra are strong choices for installment shopping, but the better option depends on what you prioritise.

- Choose Coppel if you want broader department-store financing and long-term “quincenas” plans through Coppel/ BanCoppel.

- Choose Elektra if you prefer Banco Azteca ecosystem offers, frequent bank promotions, and marketplace flexibility on monthly plans.

How do Coppel’s installment options work?

Direct answer: Coppel offers department-store credit, card-based MSI and long-term instalments (quincenas), managed through Coppel credit and BanCoppel.

Details

- Crédito Coppel / BanCoppel: Coppel issues in-house credit and partners with BanCoppel to provide credit cards that often have MSI promotions of 3 to 24 months—and, for some product categories, even longer quincena plans such as 24–72 quincenas for furniture depending on the product and credit assessment.

- Advantages: Easy onboarding (often without strict income proofs), predictable fixed payments, integrated store promotions and reward programs.

- Watchouts: Interest, fees, or higher list prices can offset perceived savings—always check the final installment table before accepting.

How does Elektra’s installment system work?

Direct answer: Elektra uses Banco Azteca and its own credit options, plus “pagos fijos” and MSI promotions that depend on bank partners and product category.

Details

- Banco Azteca / Tarjeta Elektra: Elektra commonly uses Banco Azteca-backed financing and allows fixed monthly plans and MSI with various participating banks. Payment options and fees vary by product and chosen payment method (card, PayPal, etc.).

- Advantages: Frequent bank promotion tie-ins, flexible payment terms, and a large footprint with many in-store promotions.

- Watchouts: Some items may only offer financing with cost (financiamiento con costo) rather than true MSI—read the checkout breakdown.

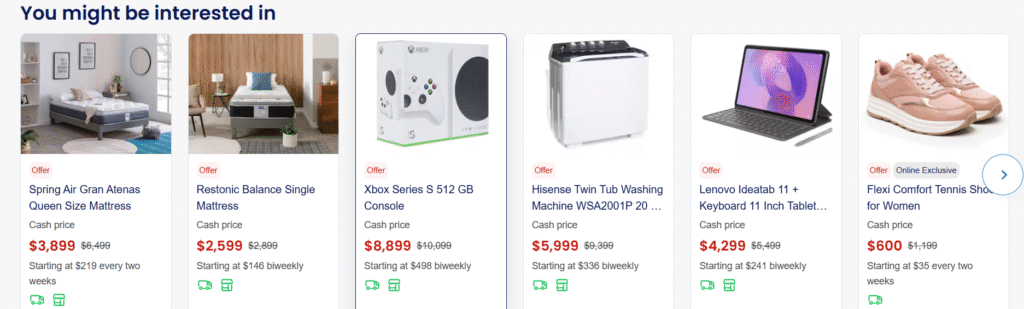

Side-by-side comparison (table)

| Factor | Coppel | Elektra |

| Primary credit vehicle | Crédito Coppel / BanCoppel (departmental card) | Banco Azteca / Tarjeta Elektra; also PayPal options |

| Typical MSI lengths | 3–24 months (MSI); long quincenas for furniture (24–72) | 3–24 months (MSI) and financed plans; varies with bank promotions |

| Availability | Very extensive national network; expanding logistics and branches. | Strong presence; tied to Banco Azteca’s financial services and Grupo Elektra network. |

| Best for | Furniture and household instalments with long-term quincenas | Promotional bank deals, electronics, and combo offers (bank + store) |

| Customer service & claims | Departmental credit support; store & online channels | Bank-backed dispute channels plus Elektra customer support |

(Sources: Coppel product pages, BanCoppel pages, Elektra payments page, Banco Azteca promotions.)

Who benefits most from each store?

- Frequent Coppel shoppers / furniture buyers — Best if you want long quincena plans, predictable installments, and integrated store credit. Consider Coppel if you need high-ticket home goods and prefer departmental credit.

- Deal-seekers and electronics buyers — Elektra often runs bank promotions with Banco Azteca or partner banks; it’s competitive during seasonal sales. If you hunt for time-limited bank promos or want to mix payment methods, Elektra can be advantageous.

Practical shopping checklist (step-by-step)

- Check the final installment table at checkout—verify total cost and monthly payment.

- Compare retailer price vs. financed cost—sometimes “interest-free” is offset by higher sticker price.

- Verify participating banks for MSI—some cards are excluded from offers.

- Read return and cancellation policy—financing reversal can be complex.

- Consider after-sales support & warranties—bank-financed items and store credit processes differ.

Final recommendation

If you need long-term, predictable departmental credit (especially for furniture or household financing), Coppel often leads with extended quincenas and integrated store credit.

If you prioritise bank promotions, competitive electronics deals, and flexible payment partners, Elektra (Banco Azteca ecosystem) may give you better short-term bargains—provided you check the final cost and financing terms.